Update: Childminders and Making Tax Digital (MTD)

On 19th January 2026, Childcare.co.uk met with HMRC to discuss childminders, MTD, expenses and the forthcoming changes. Read more about our HMRC meeting.

Further to our recent Update for Childminders on MTD and the 10% Wear and Tear Allowance, Childcare.co.uk have been continuing their discussions with senior policy advisors at HMRC.

We had recently received official confirmation that the former agreement between HMRC and childminders is being withdrawn for childminders using Making Tax Digital (MTD) and that childminders will be required to starting using MTD between 6th April 2026 and 6th April 2028 depending upon their income.

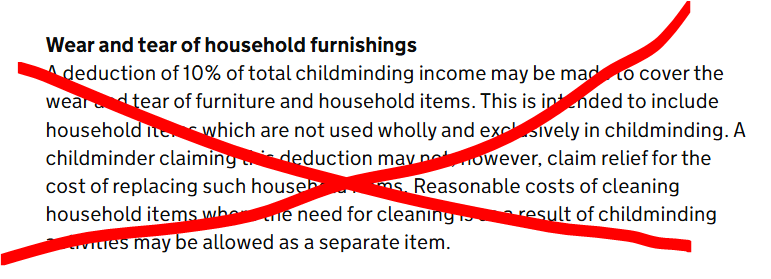

This means that the 10% wear and tear allowance that childminders have been able to use since 2013 is being withdrawn for childminders using MTD.

What do we know so far?

1. Childminders must switch to using MTD between 6th April 2026 and 6th April 2028 depending upon their income.

• If your childminding income is over £50,000 you must use MTD from 6th April 2026.

• If your childminding income is between £30,000 and £50,000 then you must use MTD from 6th April 2027.

• If your childminding income is between £20,000 and £30,000 then you must use MTD from 6th April 2028.

2. The historic agreement, known as HMRC BIM52751, will be withdrawn for childminders using MTD.

Childminders will be able to continue using the allowances set-out in the agreement until such a time as they start to use MTD.

3. The 10% wear and tear allowance will be removed for childminders using MTD

Childminders can continue to claim the 10% wear and tear allowance until they switch to MTD.

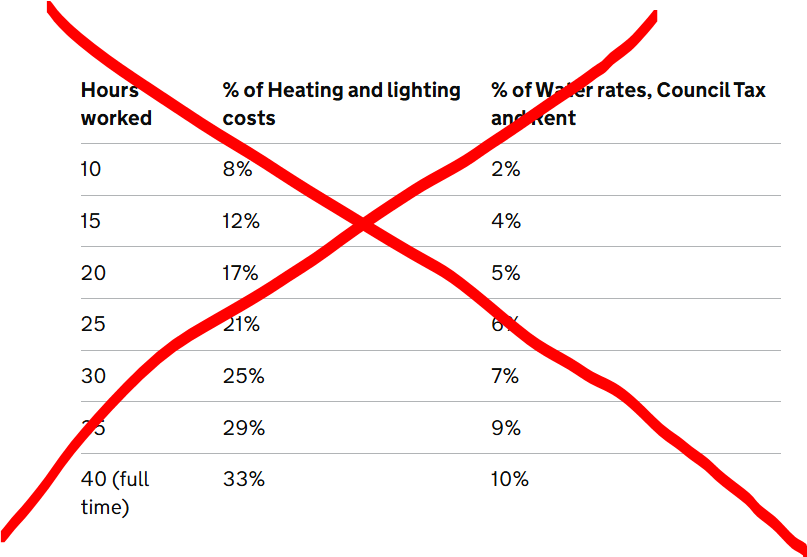

4. The household expenditure rates and allowances in the agreement are being withdrawn when MTD starts.

The agreement detailed the percentages of costs that childminders could claim in relation to heating, lighting, water rates, council tax and rent, based upon the number of hours worked per week. We have had confirmation from HMRC that this is being withdrawn for childminders using MTD.

5. HMRC have just released a factsheet sheet for childminders on expenses and record keeping which they have asked us to share.

You can read the HMRC factsheet which doesn't say very much but we have provided further updates below.

What have you been doing?

We have been in continued dialogue with senior policy advisors at HMRC and have conveyed our, and our 38,000 childminder members, disappointment and annoyance about the removal of the 10% wear and tear allowance.

We have sought to find alternative measures that childminders can use to try and ensure they are not financially penalised by the removal of the allowance.

HMRC have confirmed to Childcare.co.uk that childminders can claim tax relief for the costs of purchasing, repairing, and replacing items, used for their business.

HMRC have confirmed that for items in your household purchased for both business and personal use, childminders can claim a proportion of the costs, based on an estimate of the proportion of use, such as "50/50, 80/20, or any other split".

HMRC said: "Childminders can deduct many other costs, such as utilities, cleaning and equipment, as long as they are incurred for business purposes. We do not provide an exhaustive list, allowing flexibility for childminders to decide which costs they have incurred wholly or partly for business purposes, based on their own individual circumstances. It could be that getting tax relief for the actual costs incurred may be more beneficial to childminders, so the expenses associated with the valuable work they do are reflected in their tax calculation."

HMRC have confirmed that childminders can claim for the cost of expenses whether they use traditional accounting, or cash basis accounting. Cash basis accounting has been the default method for self-employed individuals since April 2025. A recent poll on our Independent Childminders facebook group, found that 95% of childminders use cash basis accounting.

HMRC have confirmed that household expenditure' rates detailed in the agreement will not continue on the same basis once childminders start using MTD. Instead they should use HMRC self-employed rules on expenses for household bills.

What can I claim for?

We will be producing a free guide for childminders in due course that HMRC have offered to help Childcare.co.uk produce.

Essentially, you will be able to claim the cost of things you purchase solely for your childminding business and a proportion of the cost of items purchased that are used both for your business and personally.

There are some examples on the HMRC website about claiming for items that are used in both a business and personal capacity, such as a laptop and mobile phone bill.

Note that childminders using cash basis accounting cannot claim capital allowances, but HMRC say, "the principle is exactly the same except they just deduct a proportion of the cost as with any other expense".

In relation to 'household expenditure' as detailed in the original agreement, HMRC told us:

"On household expenditure, although childminders can’t use the numbers in the table on BIM52751, they can follow the approach other businesses use when apportioning personal and business expenditure on the use of the home, which may end up getting them to similar percentages."

This is detailed on the 'If you work from home' section of the Expenses if you're self-employed page of the HMRC website. HMRC say there is more detail on BIM47815 - Specific deductions: use of home: apportioning the expenditure about the concepts of using area, usage and time to determine a reasonable apportionment.

Are the changes good?

For some childminders they might be better off, but for others they may be worse off. The 10% wear and tear allowance was fair and simple. Childminders have told us that they don't want to lose the allowance and we will continue to campaign and lobby HMRC and the wider government to change their mind over the decision to remove it.

We will continue to provide updates on this to all childminders as soon as we receive them.

Don’t have an account? Register free today

Create a free account

Sign up in one minute, no payment details required.

Member benefits include:

- Add a free profile detailing your requirements or services

- Search by postcode for local members near you

- Read and reply to messages for free

- Optional paid services available